Roofing Tips & Guides

Expert Roofing Advice for Charlotte Homeowners

Learn from Charlotte's trusted roofing experts. Tips on maintenance, repair, replacement, and protecting your home from the elements.

Learn from Charlotte's trusted roofing experts. Tips on maintenance, repair, replacement, and protecting your home from the elements.

You just discovered storm damage on your roof. Maybe it was last night's hail in Huntersville. Or that wind event that tore through Lake Norman. Your stomach drops. You know you need to file an insurance claim. And suddenly, you're staring down a mountain of paperwork, phone calls, and unfamiliar terms.

Here's the good news: filing a roof insurance claim doesn't have to feel like solving a puzzle blindfolded.

We've helped hundreds of Charlotte homeowners navigate this exact process. And we've learned that the difference between a smooth claim and a nightmare usually comes down to one thing. Knowing the steps before you take them.

This guide is your roadmap. Follow it, and you'll walk through the process with confidence. No headaches required.

Let's be real. Your roof is probably your home's most expensive component. A full replacement in the Charlotte area can run anywhere from $8,000 to $25,000 or more. That's a serious investment.

Insurance exists to protect you from unexpected damage. But insurance companies aren't exactly handing out checks for fun. They need documentation. They need proof. And they need you to follow their process.

The homeowners who get fair settlements? They're the ones who understand how the game works. Not because they're trying to cheat the system. Because they're prepared.

The storm just passed. You're anxious to know how bad it is. But before you climb any ladders or call anyone, grab your phone.

Your first job is to become a photographer.

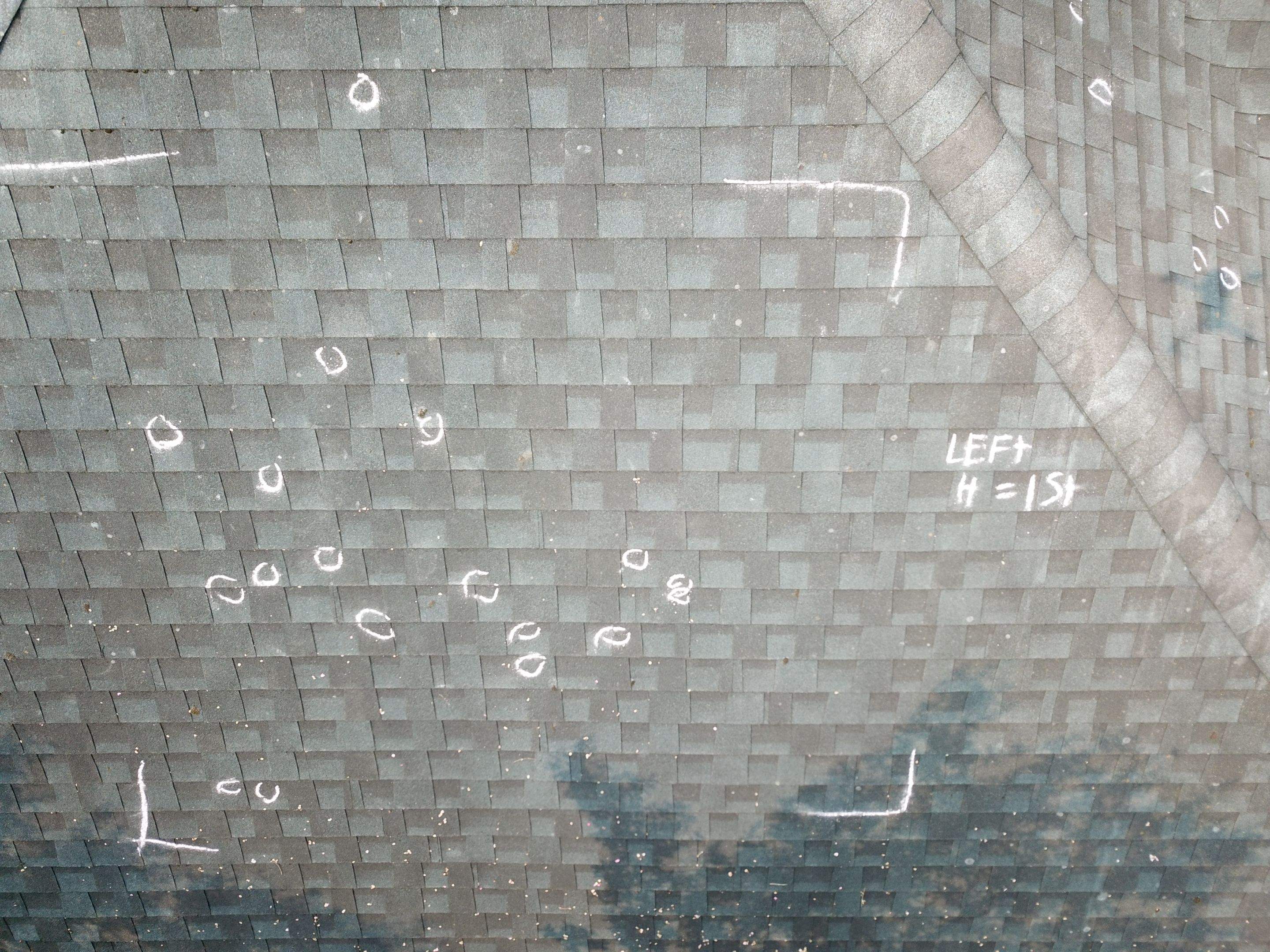

Walk around your home and capture everything you see. Missing shingles. Dented gutters. Broken tree limbs on your roof. Water stains on your ceiling. Get photos from multiple angles. Take videos of active leaks.

Pro tip: Make sure your phone's timestamp and location services are on. This creates a digital record of when and where the damage occurred. Insurance adjusters love this kind of detail.

According to the Insurance Information Institute, thorough documentation is one of the most important factors in getting a fair claim settlement. Don't skip this step.

What to photograph:

I know. Reading insurance documents sounds about as fun as a root canal. But this step can save you thousands of dollars.

Before you file anything, pull out your homeowner's policy. Look for three key things:

Coverage limits: This is the maximum your insurer will pay. Most Charlotte homes have replacement cost coverage. This means they'll pay to replace your roof with similar materials. Some older policies have "actual cash value" coverage. That factors in depreciation and pays less.

Your deductible: This is what you pay out of pocket before insurance kicks in. In North Carolina, most roof deductibles range from $1,000 to $2,500. Some policies have percentage-based deductibles for wind or hail damage.

Exclusions: What isn't covered? Wear and tear? Neglect? Certain storm types? Know these before you file.

Understanding your policy prevents nasty surprises later. And it helps you ask better questions when you talk to your adjuster.

Time matters here. Most insurance policies require "prompt notification" of damage. While North Carolina law generally gives you up to a year to file, waiting hurts your claim.

Why? Because the longer you wait, the harder it becomes to prove the damage came from a specific storm. Insurance companies know this. And they'll use it.

How to file:

What they'll ask:

Keep the conversation simple. Report the facts. Don't speculate about repair costs or make definitive statements about what happened. That's what inspections are for.

Here's where homeowners often go wrong. They wait for the insurance adjuster to tell them what's damaged.

But insurance adjusters work for the insurance company. Not for you. Their job is to assess damage fairly. But they're also human. They can miss things. Especially hidden damage that's not visible from ground level.

Get your own inspection first.

A qualified roofing contractor will climb on your roof. They'll check for damage you can't see from the ground. They'll look at your flashing, vents, and underlayment. They'll document everything with photos and measurements.

At Best Roofing Now, our storm damage inspections include drone photography for hard-to-reach areas. We provide detailed written reports with photos. And we'll meet with your adjuster to make sure nothing gets missed.

This independent assessment gives you leverage. If the adjuster's estimate seems low, you have documentation to support a supplement request.

Your insurance company will send an adjuster to inspect your roof. This is a critical moment. How you prepare can significantly impact your settlement.

Before the adjuster arrives:

During the inspection:

After the inspection:

⚠️ Important: Never accept a verbal estimate. Get everything in writing. And don't feel pressured to agree to anything on the spot.

Within a week or two, you'll receive a settlement offer from your insurance company. This document explains what they'll pay for and how much.

Read it carefully. Compare it to your contractor's estimate.

If the numbers match up: Great! You're ready to move forward with repairs.

If the insurance estimate is lower: Don't panic. This is common. You have options.

You can file a "supplement" to your claim. This is a formal request for additional funds based on new information or damage that was missed. Your roofing contractor can help you document the discrepancy.

According to industry experts, initial insurance estimates often undervalue repair costs. The National Roofing Contractors Association recommends always getting an independent assessment before accepting a settlement.

At Best Roofing Now, we handle supplement requests regularly. We know what documentation adjusters need. And we'll advocate for you to get a fair settlement.

Once your claim is approved, it's time to actually fix your roof. This is where choosing the right contractor matters most.

Red flags to avoid:

What to look for:

Your insurance company may issue payment in stages. Often, you'll receive an initial check minus your deductible. After repairs are complete, they'll release the remaining funds (called "recoverable depreciation") once you provide invoices.

After helping hundreds of families through this process, we've seen patterns. Here are the mistakes that cost homeowners the most:

Waiting too long to file: The damage gets worse. The connection to a specific storm gets harder to prove. File within 24-48 hours when possible.

Not documenting enough: You can never have too many photos. Take hundreds. Seriously.

Accepting the first offer without question: Initial estimates are often low. Get your own inspection. Ask questions. Request supplements when needed.

Hiring the wrong contractor: Storm chasers prey on homeowners in crisis. Stick with established local companies who will be here long after the repair is done.

Not understanding their policy: Surprises during a claim are never good surprises. Know your coverage, deductible, and exclusions before you need them.

| Timeframe | What Happens |

|---|---|

| Day 1-2 | Document damage, file claim, arrange emergency tarping if needed |

| Day 3-7 | Get independent roof inspection, prepare for adjuster |

| Day 7-14 | Adjuster visits, initial estimate provided |

| Day 14-30 | Review settlement, file supplements if needed, select contractor |

| Day 30-60 | Repairs completed, final payment received |

After major regional storms, these timelines can stretch. Insurance companies get flooded with claims. Stay patient but persistent. Follow up regularly.

Look, filing an insurance claim will never be "fun." But it doesn't have to be a nightmare either.

The secret is preparation. Document everything. Know your policy. Get professional help. And don't be afraid to advocate for yourself.

At Best Roofing Now, we've walked alongside Charlotte and Lake Norman homeowners through every step of this process. From emergency tarping to meeting adjusters to completing repairs. We're local. We're not going anywhere. And we genuinely want to help you get your home back to normal.

✅ Ready to get started? Schedule your free storm damage inspection today. We'll assess your roof, provide detailed documentation, and help you navigate your insurance claim from start to finish.

Call (704) 605-6047 or visit our website to request an appointment. Let's take the headache out of this together.

Best Roofing Now

Charlotte's trusted roofing experts since 2019

Based on this article, you may be interested in these services.

We proudly serve these Charlotte-area communities with professional roofing services.

View All Service Areas →Get a free roof inspection and honest assessment from Charlotte's most trusted roofing company.